There’s more to hiring than just paying a salary. If a business is striving to grow slowly and make responsible plans for its spending, knowing how much each employee costs is very important. That number can guide financial expectations, adjust ways employees are hired, and shape a company’s trajectory.

We’re going to look into what defines the total cost of someone’s work, why it counts, and how you handle it. Our main job is understanding the Exact Cost of an Employee, as well as discovering how to calculate and manage that cost successfully

Why Understanding the Exact Cost of an Employee Matters

When you operate a business, one of the biggest expenses might be labor costs. But many companies incorrectly assume this number because they only review gross income. In fact, the issue is much more difficult than it seems.

The true employee cost consists of taxes, training expenses, and the costs associated with the workspace. To keep up and make profits, companies have to accurately know how much they spend on each employee. It provides a way for:

- Better planning of money.

- Strategic hiring

- Better investment in training and retention

- Projections for expanding the business

2. Core Components of Employee Cost

We can best understand employee cost by looking at what makes it up. Here’s how to calculate the price you’ll pay for an employee:

a. Base Salary

This is the clearest expense, but it’s also just the beginning. It means you pay before taxes and other deductions.

b. Payroll Taxes

Firms need to manage and file taxes on their employees’ earnings. These include:

- Social Security

- Medicare

- Taxes for Unemployment at the Federal and State Level

c. Benefits

Benefits can costs can make up a large part of what a company pays its employees. Examples include:

- Insurance plans for health, dental, and vision

- Life insurance

- Disability insurance

- Retirement savings plans do not include contributions from 401k matching or similar programs.

d. There are bonuses and incentives.

The total cost of employees includes commission, year-end bonuses, and performance-related incentives.

e. Recruitment Expenses

It takes money to find the right people for the job. How much does it cost to post a job on a job board? The fee you collect comes from the recruitment agency’s charge. Travel to interviews and evaluation steps

f. Training and getting employees up-to-date

Every new person needs to be brought up to speed by the company, using time and resources. Consider:

- Onboarding programs

- Time used by managers for training

- The cost of our courses or getting certified

g. Equipment

- Machine or tool needed to produce a product, including items such as printers, presses, and scanners.

- Employees usually need specific tools to do their jobs well.

- Laptops and all types of technology accessories

- Software licenses

- The use of phones or similar devices

h. Office and Services

The expenses for employees exist no matter the work situation, whether remote or at the office.

- Office rent and bill payments for utilities

- Software designed for communication

- Furniture purchase and care

i. Employee Perks

Even optional benefits can change the price of employing someone.

- Gym memberships

- School cooking or snack programs

- Assistance with well-being or mental health

3. How to Calculate Total Employee Cost

We can make a simple calculation to understand the employee cost.

Total Employee Cost is simply the Base Salary.

You will need to pay payroll taxes.

- + Benefits

- + Bonuses

- + Recruitment

- + Training

- + Equipment

- + Workspace

- + Perks

An example is this: A company may actually spend $95,000 to $100,000 each year when a staff member earns $70,000 as a base salary.

If employee cost are clear, having no unexpected difficulties helps the business organize things better.

4. Indirect and Hidden Employee Costs

There are special costs that play a role but are very difficult to measure in a business. These include:

- Getting and training replacement staff can cost money when present staff resign.

- The time required to lose work productivity after new people come on board is called downtime.

- When staff with experience leave the company, they take their skills and knowledge with them.

Looking at these points gives you a better picture of your employee expenses.

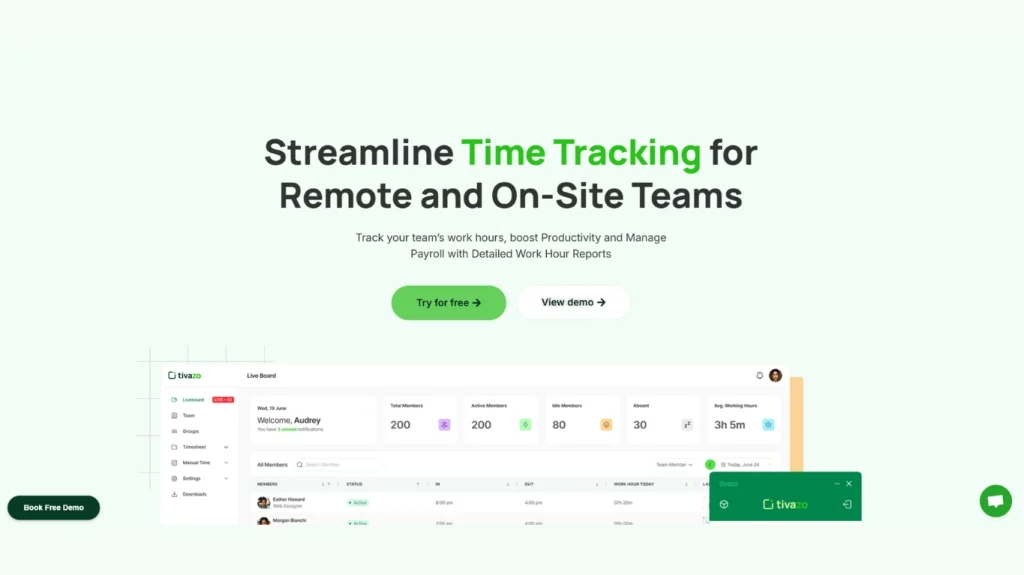

5. Tools to Track and Optimize Employee Cost

Modern technology allows companies to keep tabs on and control their spending on labor. These technologies are equipped with functions such as:

- Immediate views of your payroll data

- Benefit tracking

- Analyses of the financial returns from employee programs

- Predicting what it will cost to employ people in the future

Examples are Gusto, ADP, BambooHR, and QuickBooks Payroll. With such programs, businesses are able to calculate the real cost of an employee without having to do manual work.

6. How Employee Cost Varies by Country and Role

Hiring for different offices or roles in different parts of a company normally changes the budget for employees. For people in the U.S., healthcare often adds significant expenses, but those in places with government health systems usually pay less. In the same way, technology jobs may cost more since employees depend on expensive gear and need continuous training.

The best way to calculate an employee’s cost for the business is with a region-specific and role-specific system.

7. Best Practices to Control Employee Cost

Given the right conditions, about half of your overhead costs may be improved without negatively affecting staff.

- Train employees on multiple tasks so you don’t have to hire someone new for each position.

- Offer activities that are outside your primary areas to outsiders if they can be done better.

- Focus on retention so you don’t have to spend extra money on replacing workers

- Review your benefits from time to time to check that they are both up-to-date and budget-friendly.

With these tools in mind, companies can control their spending on staff.

8. Employee Cost in Small Businesses vs. Enterprises

Sometimes, it’s the smaller companies that notice high employee spending more severely than bigger firms. Unlike larger companies, they are not helped by how much they grow in hiring employees or operating from offices.

It is even more important to know the true cost of an employee in a small business, since new hiring can have a big impact on cash flow.

9. Budgeting and Forecasting Using Employee Cost Data

With clear numbers on employee costs, businesses are able to:

- Make your budgets more precise.

- Limit the number of people hired in each department.

- Investigate and track the proportion between revenue and labor cost.

- Consider what the right strategy is for scaling your business

- It forms a major part of effective HR and finance planning.

Conclusion

A lack of awareness about all staffing costs can result in unexpected expenses and missed business opportunities for companies. Business decisions improve the more detailed our understanding.

Companies should use specific projections because employee costs are key to strategy. Getting the right number for each employee helps hiring, growing, and keeping staff easier.

Try to make it a habit. Make it a regular part of how your family works. Try to help each employee you bring on understand the cost and benefit they add to the organization.

Key Takeaways

- What a business pays in base wages is just a small part of what the employee actually costs.

- Salaries need to cover taxes, benefits, training, everything used at work, and any bonuses.

- You can use useful tools and strategies to predict the cost of all employees.

- Variations in culture and work position are important

- Figuring out employee expenses aids in the right recruitment choices and budget planning.

Strongly managing this important cost for their business, companies gain confidence and stability in their growth.

What is the cost to employers for each employee?

It includes salary, benefits, taxes, insurance, and overhead—often 1.25–1.4× the base salary.

What is the cost per employee metric?

It’s the average total cost per employee, including compensation, benefits, and indirect expenses.

What is the formula for manpower cost?

Manpower Cost = (Salary + Benefits + Taxes + Bonuses) × Number of Employees