One of the common questions asked as a person steps into the workforce for the first time or changes jobs What is biweekly pay all about. It is important that one must be aware of being paid per hour, per week, or per day to transform the funds into bills. Moving further, the news guides through everything one must learn about biweekly pay systems-from the minute of its existence and further computation methods to whether and how it may be compared with other pay systems.

Key Highlights:

- What is Biweekly Pay?

- Biweekly Pay and Budgeting: Tips for Employees

- Is Biweekly Every 14 Days? Are you Biweekly every 14 Days?

- Calculate Your Biweekly Salary

- How Much $15 an Hour Biweekly?

What is Biweekly Pay?

Biweekly pay is very popular, particularly in the United States, and is common in an array of occupations, including health care, education, retail, and administration. One of the things it strikes a fine balance between is the needs of the employee and the convenience of the employer. Paying employees on a biweekly schedule sets a better cadence for income flow for workers as it assists with keeping cash or cash equivalents handy to buy weekly groceries, pay for water, or pay for minor utilities with recurring expenses. A plus for the employers is the efficiency of setting up payroll every two weeks-faster than weekly schedules-while maintaining employee satisfaction.

An important factor to remember is that the biweekly salary differs from a semimonthly salary, even though they seem alike at the start. Biweekly pay is paid every other week, no matter the calendar month, whereas semi-monthly pay is paid on fixed dates during the month, such as the 15th and 30th. The distinction becomes significant as it affects the amount one gets paid and how one can budget for expenses, especially for those who are hourly-based. So, in the curious question “what is biweekly pay?”

Is Biweekly Every 2 Weeks or Twice a Week?

This is a common question because the prefix “bi” does seem to mean both “two” and “twice.” Perhaps biweekly is said to be every 2 weeks or twice a week? Biweekly always refers to being every two weeks and never twice a week when it concerns payment schedules.

To clarify:

- Biweekly pay = Every 2 weeks (i.e., 26 times a year)

- Semiweekly = Twice a week (which is very rare in payroll systems)

If you’re still skeptical about what could constitute biweekly pay, know that it is a fixed schedule of payment, once every fourteen days-not twice a week.

A newcomer to payroll lingo might have trouble with that. However, companies and HR departments use the terminology biweekly in the accepted manner, meaning every two weeks. This very confusion could have allowed someone to question when the next paycheck could land in the mortgage account. When in doubt, clarify with your employer or the HR department. Knowledge of what is biweekly pay is assures you of handling your income well and circumvents surprises while attempting to set monthly budgets or automatic payments.

Biweekly Pay and Budgeting: Tips for Employees

After learning about the biweekly pay, one might adjust their budgeting strategies.

Budget Tips:

- Plan for those months with 3 paychecks — treat that gift money well!

- Split rent or utility expenses, which are generally paid monthly, into two pay periods.

- Set aside a little from each paycheck for emergencies or unexpected expenses.

Knowledge of what is biweekly pay can seriously help make cutting-edge financial planning.

Is Biweekly Every 14 Days? Are you Biweekly every 14 Days?

Yes. Biweekly pay is every 14 days. For example, if you get paid on Friday, 4 July, your next paycheck will be on Friday, 18 July. This formula is kept up with, so in most months, the employee gets two paychecks, and for two months every year, they get three paychecks.

What is biweekly pay in terms of being consistent? It is predictable and evenly spaced, making it easier for many people to budget than a monthly program.

This is good for workers living paycheck to paycheck or ones who like having a more frequent inflow of income to balance bills and savings. With a paycheck coming every two weeks, most workers find it easier to stretch out their expenses; they put one paycheck toward rent and utilities and the other toward groceries, transport, or paying down some debts.

Knowing what is biweekly pay and how the 14-day cycle works makes it possible to plan for those months when an “extra paycheck” surfs in. The two times a year these bonus pay periods occur could be autoloaded into retirement savings, fast-tracked towards paying off debt, or even snatched to splurge on a short vacation. The console of biweekly pay console gives workers more options to control their finances than others, such as semimonthly or monthly.

Therefore, understanding what is biweekly pay can save you the surprise of that new paycheck once in a while. It aids in beneficial money planning and assures peace of mind when balancing income.

How Does Biweekly Pay Work?

From start to finish, here’s a 9-step breakdown of how biweekly pay works:

- Your employer sets a biweekly pay schedule: for example, every other Friday.

- You work for 14 days.

- After the period, you get your paycheck either right away or with minimal delay for payroll processing.

- This continues throughout the year, so that with occasional exceptions occurring in leap years, such scenarios are credited with 26 paychecks.

Thus, whenever you ask what is biweekly pay, think of it as receiving your pay for your labor every two weeks like clockwork.

Each pay period is usually an 80-hour work week for full-time employees (40 hours x 2). This makes biweekly pay the easiest approach for recording working hours and determining overtime, if applicable. It provides consistency for both employees and employers.

For salaried employees, being paid biweekly means dividing their annual salary into 26 equal payments. For the hourly workers, each paycheck is a reflection of actual hours worked during that particular two-week period. Knowing what is biweekly pay allows you to track earnings accurately and get ready for taxes, as well as fit your budget around your pay cycle.

This definition answers the fundamental question of what is biweekly pay.

Calculate Your Biweekly Salary

Step 1

Take the annual salary and divide it by 26 to obtain the biweekly salary.

Step 2

If the annual salary is $52,000, then the calculation goes as follows:

$52,000 / 26 = $2,000

Your biweekly pay, subject to other deductions, will be $2,000.

Step 3

If one is hourly, the procedure differs. For example, when someone gets $15 an hour for 40 hours a week, when calculating biweekly wages, one would do:

$15 x 40 hours x 2 weeks = $1,200

Therefore, realize that biweekly pay is of utmost importance because it affects your pay rhythm and budget.

How Much $15 an Hour Biweekly?

If you earn $15 an hour and work full time (80 hours every two weeks), you would make:

$15 x 80 hours = $1,200

Let’s try to make it simple:

| Hourly Rate | Weekly Hours | Biweekly Hours | Biweekly Pay |

| $15 | 40 | 80 | $1,200 |

| $15 | 35 | 70 | $1,050 |

| $15 | 30 | 60 | $900 |

Thus, biweekly pay would depend on the total number of hours worked every two weeks at $15/hour.

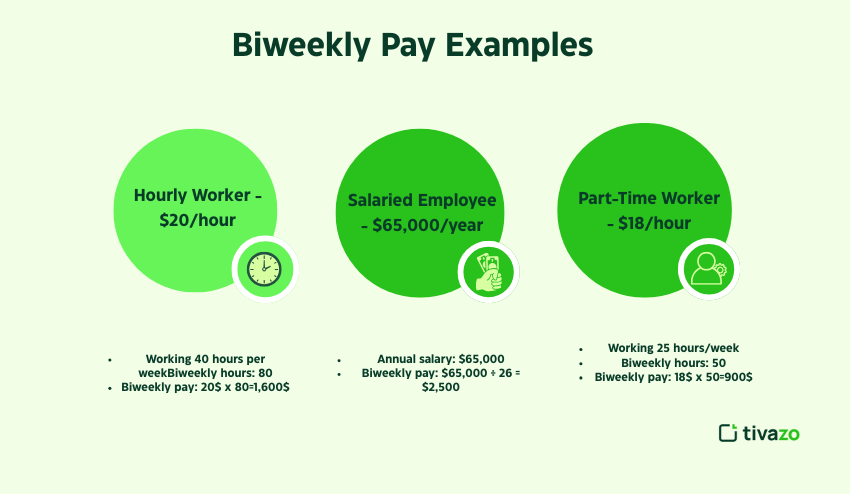

Biweekly Pay Examples

Here are some income scenarios to help make biweekly pay more real to understand:

1. Hourly Worker – $20/hour

- Working 40 hours per week

- Biweekly hours: 80

- Biweekly pay: 20$ x 80=1,600$

2. Salaried Employee – $65,000/year

- Annual salary: $65,000

- Biweekly pay: $65,000 ÷ 26 = $2,500

3. Part-Time Worker – $18/hour

- Working 25 hours/week

- Biweekly hours: 50

- Biweekly pay: 18$ x 50=900$

This elaborates on what is biweekly pay is and its application in real-world hourly and salaried jobs.

Let’s take it a notch higher. If you make $22 per hour and sometimes accumulate some overtime, then your biweekly pay changes. Maybe you worked a total of 85 hours in two weeks:

- 22$ x 85 = 1870$

Because the schedule changes and overtime pay options are viable, getting down to understanding exactly what is biweekly pay is is important.

Biweekly Pay vs. Other Pay Schedules

To understand fully the basics of what is biweekly pay, one usually regards other payroll schedules:

| Pay Schedule | Frequency | Checks Per Year | Notes |

| Weekly | Every seven days | 52 | Frequent but heavy on administration |

| Biweekly | Every 14 days | 26 | Most common schedule in the U.S.A |

| Semimonthly | Twice a month | 24 | On fixed dates, mostly the 15th & 30th |

| Monthly | Once a month | 12 | Easy, but hard to keep to a budget |

Among these, biweekly pay sits nicely on the scale between higher-than-average frequency and ease from an administrative point of view.

Why Do Employers Opt for Biweekly Pay?

Having established what is biweekly pay, let’s look at why many companies prefer it:

Benefits for Employers:

- Strained payroll operations (compared to weekly): Running payroll every two weeks lessens the work among other administrative processes and balances the on-time payments given to the employee due to its compliance with the law.

- Labor laws-following (especially overtime): For the hourly employees, overtime calculation gets easier with a two-week pay schedule, as it fits nicely with the weekly tracking systems.

- Being Easy to manage with Automatic Payroll Systems: Almost all recent software platforms are designed with optimization for biweekly schedules so the calculations, deductions, and reports flow seamlessly.

Benefits for Employees:

- Every two weeks, steady income: Regular paydays instill a degree of financial security and confidence in employees.

- Better budgeting compared with monthly pay: Biweekly pay breaks monthly bills down into less frightening amounts, lessening the likelihood that employees will give in to overspending.

- Bonus: Two months out of the year with an extra payday! These “three-paycheck months” are great times to save, invest, or meet unexpected expenses.

Understanding what is biweekly pay is would reveal to us why it is a wise choice for both sides. The biweekly pay gives a balance between efficiency and employee satisfaction, which is why you will find it practiced in some sectors such as the health sector, education, finance, and retail. The pay type is gaining ground as a result of the mutually beneficial perspectives.

What Does Biweekly Pay Mean for Contractors or Freelancers?

Most freelancers or independent contractors are paid on a per-project or per-invoice basis, but some very big entities do maintain biweekly pay for their contract workers.

If you get into some form of recurring contract, then having a very clear understanding of what is biweekly pay will help you negotiate payment terms better and set out payment frequency expectations.

For example, a contractor engaged in a long-term project may issue invoices every two weeks and be paid every two weeks, just as regular employees do. It benefits both parties: the contractors to have a steady cash flow, and clients to plan the payment. Knowing what is biweekly pay lets freelancers better plan their finances regarding income forecasting and tax planning.

How to Determine If You Are Getting Paid on a Biweekly Basis

Are you wondering if your employer does that sort of pay system on a biweekly basis?

Look for-

- Pay stubs dated exactly 14 days apart,

- 26 total payments per year,

- Generally the day of the week every other week.

By applying this, you would have answered the question of what is biweekly pay for your job.

You will find another clue in the employee manual or pay calendar, which usually states the pay frequency. Just call HR. Understanding what is biweekly pay will clear up any confusion in your mind as to when you will be getting paid, thereby easing your finances confidently.

Conclusion

Well, what is biweekly pay, and why does it matter? The system is a schedule that, in turn, shapes one’s budget, saving, and planning for their future. Whether you were a $15-an-hour hourly worker or were paid $80,000 per year as an office employee, biweekly pay strikes a balance between regularity and financial flexibility.

Knowing what biweekly pay is is empowering in controlling your finances and career, from paycheck calculations to budgeting worksheets and examples in real life.

It also helps avoid unwelcome surprises, especially in those months that gift you a third paycheck. That extra paycheck is a great time to save some money or chip away at your debt. Pay in biweekly is among the rare schedules that can really be fine-tuned towards working for you with a bit of planning and attention. Understanding what biweekly pay is puts you in control over how you spend, save, and negotiate job offers, whether you are just entering the labor force or juggling multiple income streams.

Is biweekly every 14 days?

The biweekly pay frequency basically covers the 14 days from one Sunday to the Saturday two weeks hence. Employees are paid every 14 days, and that means 26 pay periods in a calendar year consisting of 52 weeks.

What is your biweekly salary?

A biweekly payroll processes payroll and pays employees every 14 days on specific days. Payment via a paycheck or direct deposit set to arrive every other Friday would be an example of a biweekly payroll system.

How much is $15 an hour biweekly?

How much is $15 an hour bi-weekly? If you are paid hourly at $15, your bi-weekly paycheck would be somewhere about $1,200. To look at this closer, multiply the hourly rate by the number of hours worked for two weeks, which for this example is 80. Hence, $15 times 80 results in $1,200 for the bi-weekly period.