A raise of 3 percent may appear to be a step forward. But in 2025, with increased costs and rising inflation, it begs the question in everyone’s mind: ‘Is 3% raise enough?’ And what is a 3 percent raise in real terms?” In this absolute guide, we will discuss what a 3 percent raise means, how to calculate it, what it is in real dollars, and whether it is even a step forward in your financial life, or simply keeping you from sliding back into a corner and master how to calculate a 3% raise on salary with ease.

Whether you make hourly, a salary, or a freelance rate, this blog contains every answer you are looking for.

Key Highlights:

- What Is a 3 Percent Raise? (Simple Definition)

- 3% Raise Salary Examples (Annual & Hourly)

- Is a 3% Raise Good in 2025?

- Gross vs Net: What You Take Home

- Compounding Effect of Raises Over Time

What Is a 3 Percent Raise? (Simple Definition)

If you’ve ever asked, ‘What is a 3 percent raise? ‘, a 3 percent raise is just that – your pay or hourly wage will go up by 3 percent of your current amount. A 3 percent raise is considered a type of annual raise or cost-of-living adjustment. While 3 percent can sound minimal at first glance, if you calculate and track your raises over an employment term, it can have a serious impact on your income over time. Here’s Exactly What It Means: a 3 percent raise.

Formula:

How to calculate a 3% raise on salary

New Pay = Current Pay × (1 + 3/100)

- If you earn $50,000 per year: $50,000 × 1.03 = $51,500

You will have $1,500 more per year.

3% Raise Salary Examples (Annual & Hourly)

A 3% raise may seem small, but how much does it add to your pay? Let’s look at a few real numbers. If you are on a salary or you’re paid hourly, even a small bump can mean hundreds—or thousands—more each year. Here’s how a 3% raise breaks down at various strong pay rates:

Annual Salaries:

3 percent raise examples:

| Current Salary | New Salary (3% Raise) | Annual Increase | Monthly Increase |

| $30,000 | $30,900 | $900 | $75.00 |

| $50,000 | $51,500 | $1,500 | $125.00 |

| $75,000 | $77,250 | $2,250 | $187.50 |

| $100,000 | $103,000 | $3,000 | $250.00 |

Hourly Wages:

3 percent raise math:

| Current Wage | New Wage (3%) | Difference per Hour | Extra per 40hr Week |

| $15.00 | $15.45 | $0.45 | $18.00 |

| $20.00 | $20.60 | $0.60 | $24.00 |

| $25.00 | $25.75 | $0.75 | $30.00 |

These numbers may seem small, but over time, they add up. Or do they? Let’s dig deeper. Use our built‑in 3 percent raise salary calculator below

Is a 3% Raise Good in 2025? When is a 3 percent raise good?

Many people ask, ‘Is a 3 percent raise good when compared to salary inflation. In 2025, a raise of 3% is likely a big letdown. Inflation is approximately 3.6%, and the cost of living is rising faster than your paycheck. As a result, your raise will not go as far in real terms, and you could be in a position where you feel you have fallen behind. In fact, according to the latest data from SHRM and the Bureau of Labor Statistics, the average increase across all occupations is 4.1%, with high-demand fields such as tech and finance earning increases between 5–7%.

The only occupations that remain in the 3% range are government and education. So, is a 3% increase any good? It could be somewhat beneficial if you’re in a strictly regulated environment with pay banding or if it were part of a general expectations performance review. Otherwise, a 3% raise is likely an indicator that you should start considering a negotiation for a more significant annual increase.

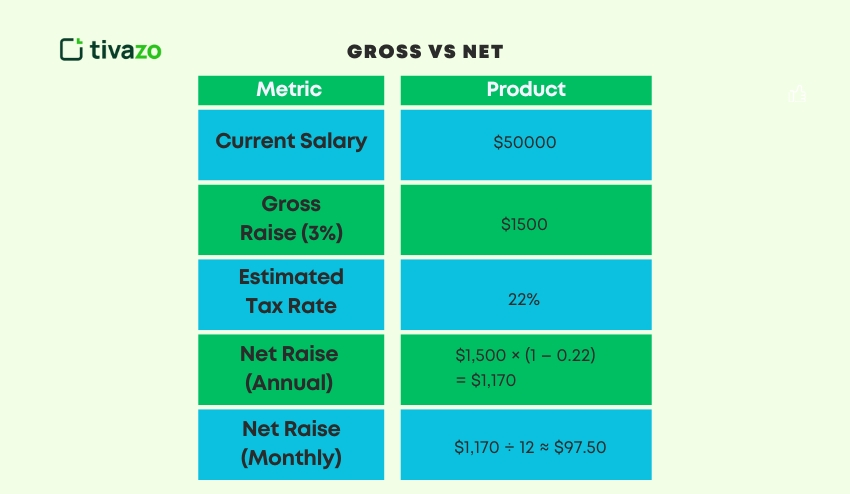

Gross vs Net: What You Take Home

When you have a raise of 3% it sounds nice until it gets dinged by taxes. How to calculate a 3% raise on salary before taxes

Let’s work with a salary of $50,000.

Raise: $1500

Estimated federal + state taxes: 22%

Final Increase: ~~$1170/yr or ~$97.50/month.

So, your $1500 raise turns into an additional $97 on your paycheck monthly.

What If You’re Paid Hourly?

Hourly workers feel neglected when it comes to salary raises, but 3% can mean a lot depending on how you figure that out. Although it may seem silly when you first look at the few cents per hour, it adds up really fast. This extra income can help offset rising costs, increase debt payments, and/or be directed into savings for your future. Let’s break down exactly what a 3% raise looks like for hourly pay:

A 3% raise for $20/hr = $20.60/hr

Weekly (40 hrs): $24 more. Monthly: ~ $96 more.

Now imagine using that extra towards your retirement or debt….that’s when it can make a slight difference with it.

Negotiating Beyond 3%: How to Ask for More

If you’ve ever wondered ‘Is a 3 percent raise good,’ here’s what to know before you negotiate. Are you feeling disappointed about your 3% raise? You’re certainly not alone and don’t have to take a 3% redistribution lying down. You have options! If you’ve performed well, you’re regularly taking on more responsibility, or inflation has outpaced your raise, you are justified in asking for even more. The time to ask again or ask for a raise is typically at a performance review or at a scheduled compensation review. Regardless of when it is, when you ask, be sure to back your request up with data, and do it confidently. For example, you could say:

“I would like to schedule a time to talk about my compensation because, based on my performance and responsibilities, and recent changes in the cost of living, I would like to adjust my compensation. I think a raise consistent with market increase, which would be around 5%, would accurately reflect my contributions.”

Pay Raise Calculator (Manual) 3 Percent Raise Calculator

What does 3% mean for your paycheck? You don’t necessarily need a fancy tool; you can perform a simple formula. Whether you are budgeting, negotiating, or thinking about your next steps, calculating your raise manually will keep you in the driver’s seat for your financial situation. You will need your current salary or hourly wage and your calculator.

Want to see your raise in real time?

Use this formula: New Salary = Current Salary × 1.03

Or: Raise Amount = Current Salary × 0.03

How a 3% Raise Compares to Cost-of-Living Adjustments (COLA)

A 3% raise may seem like a reasonable figure, but it can be insufficient when contrasted with the cost-of-living adjustment (COLA). COLA is intended to assist a salary in keeping pace with inflation, what you need in housing, food, transportation, and health care. If you’re getting a 3% raise, and inflation was 3.6% in 2025 (what the latest data was), your raise is simply lagging behind those rising costs. If your raise does not keep pace with inflation, you’re earning less, relative to purchasing power.

This is one of many reasons some employers base annual raises on the U.S. Consumer Price Index (CPI). If yours does not, then you may just be keeping up with inflation with the raise, not improving your financial circumstances.

Compounding Effect of Raises Over Time

You may feel disappointed with a 3% raise in the short term, but when you consider that the 3% raise is ultimately greater than it appears, take comfort in this concept of compounding. A raise from an employer is based on the salary you’ll be making instead of your past wage. So, if each raise builds on top of the last one, every increase is always a bit bigger than the fiscal year prior.

Consider that you are earning $50,000 and receive a yearly raise of 3%. In the second year, you’ll earn $51,500. However, in the third year, instead of the raise amount, your 3% raise is on the total of $51,500 and results in $53,045. By the fifth year, you’re up to just over $56,275, gaining more than $6,000 just through consistent 3% raises.

These consistent, compounding growth bumps create a solid basis for financial livelihood, especially when combined with sound financial practices such as a budget, retirement pay-in, or investing. It is a reminder that anything above a snail’s pace can snowball, even if it doesn’t seem like it at the beginning, into significant long-term goals. Never minimize the power of consistency with pay.

Should You Ever Accept Less Than 3%?

Before asking what is a 3 percent raise below market, weigh these factors. In the noble pursuit of free change, situations may be rare but occasionally exist in which you may consider accepting less than a 3% raise. For example, if you are working at a nonprofit non-governmental organization, an early-stage startup, or for the government, there may be some years when your salary might only grow modestly, but the offset might be another company benefit. For example, instead of some salary growth, your organization might offer perks like flexible hours, loads of paid time off, training opportunities, or stock options.

That said, a raise that does not keep pace with inflation decreases your real income. You are earning less. So you need to evaluate a complete picture: Are you getting valuable experience? Is your volume of work sustainable? Do the perks and team culture make up for the lower potential monetary compensation?

A sub-3% raise is fine for a limited amount of time, but if you stay somewhere for too long without increases that allow good compensation progression, it stunts your abilities to accumulate wealth. You deserve to be compensated for your time, your skills, and your energy—make sure your compensation reflects your value, not just your loyalty.

How to Tell If a 3% Raise Is Actually “Good”

Not every raise is equal. A 3% raise may seem nice on paper, but whether it is actually “good” depends on your particular situation. Use the checklist below to quickly assess your raise:

- Compare It to Inflation

- Is inflation greater than 3%? If it is, your real purchasing power decreased.

- Stack It Against Market Rates

- Review salary survey data from Glassdoor, Payscale & Levels.fyi for your role.

- Factor in Career Growth

- Are the responsibilities and workload increasing faster than the compensation?

- Look Beyond the Paycheck

- Healthcare benefits, paid time off, remote options, flexibility, and variable bonuses all define the offer as well.

- Consider the Timing

- Was this raise tied to possible pay due to performance, promotion, or just a matter of salary administration?

The Psychological Impact of Small Raises

Even a small raise (a 3% raise) carries tremendous psychological weight. It is a signal of recognition, appreciation, and movement forward. For the employee, it can positively enhance their morale, motivation, and sense of belonging. The opposite can also be true; when a raise does not appropriately represent either the work put in or the appreciation in costs, it can cause a motivational drop in the employee.

Psychological response is feeling they belong, or beginning to look for alternatives. This is where transparency, context, and timing are needed. A 3% raise is a number. It might not be that big of a deal, unless it is then. A 3% raise is not just a number; it is a coordination of your value and expectations. Don’t wait until it is too late, and don’t mistake too many small increases as a benchmark for reflection of value where there is no value.

When a 3% Raise Is Worth Taking

Not all raises need to be above the inflation rate to be meaningful – it depends on the context. If you are early in your career, newly onboarded, or your company just endured a tough financial season, a 3% raise can still tiptoe the line between stability and momentum.

A pay raise can also come with non-monetary benefits – more flexible hours, upskilling, or enhanced work-life balance. If the pay raise is part of a bigger playground-like setting, you may be up to receive a promotion in 6 months, taking it may be a smart career move. You just have to consider whether taking it aligns with your goals. A small raise today could be the springboard to a significantly larger one in the future.

Final Thoughts: Don’t Just Take It—Evaluate It

Even though a 3% increase may feel uplifting, it is important to recognize the context around it. It is worth your time to take a moment to assess what it is in terms of your overall financial wellness before you accept it. It is equally important to gauge the increase against inflation (CPI) rates, the current market averages within the profession, and the value you provide in your role. Sometimes a 3% increase is simply a fair cost-of-living adjustment for you, while other times it can highlight that you are underpaid.

It is important to track your earnings growth/trajectory and remain mindful. Successful professionals are the ones who don’t just accept the offer – they are negotiating, they are asking questions, and they are ensuring that their compensation aligns with their (financial) plans. Be empowered. Be proactive.

Bookmark this guide on 3 percent raise calculator tips for your next review.

FAQs

Is a 3% raise enough?

Not in high inflation years. It’s below average for many industries.

How often should you get a raise?

Annually is standard. Promotions or market adjustments can come earlier.

Does a 3% raise keep up with inflation?

Not always. If inflation is higher than 3% (like 3.6% in 2025), your purchasing power actually decreases despite the raise