The business economic cycle is important because it influences how organizations are created and operate, as well as how they perform, in a fluid and competitive environment we refer to today as the marketplace. The business economic cycle describes the phases of economic expansion and contraction that economies and businesses generally experience over time. Whether you’re an entrepreneur starting a new business, a seasoned veteran running a large organization, or an investor managing a diversified investment portfolio, understanding….

The business economic cycle will help to identify not only when the economy is experiencing a slowdown or expansion, but also the kind of investments being made, consumer behavior, and franchise performance along the way. This will help employers prepare and aim to account for changes in their business, assess and manage risk, and give businesses and investors the ability to identify and harness new opportunities in both good and bad economic times.

In this detailed guide, we will begin by describing a business economic cycle, describe the distinct stages, and discuss tangible examples of how businesses compete in the business economic cycle. In addition, we will provide actionable strategies to help your business win at any point of the cycle you find yourself in. Learning this information will ultimately allow you to create resilience and sustain growth through the natural fluctuations of economic cycles.

Keys Takeaways:

- What is the Business Economic Cycle?

- Stages of the Business Economic Cycle

- Key Factors Affecting Business Cycles

- Business Cycle and Economic Growth: What’s the Link?

- The Role of Government in Economic Cycles

- How Businesses Adapt During Different Economic Cycle Phases

- Strategies for Managing Growth and Recession in Business Cycles

- Understanding the Impact of Inflation and Interest Rates

- Smart Moves to Thrive in Any Business Economic Cycle

- Conclusion: Be Proactive, Not Reactive

- FAQs:

What is the Business Economic Cycle?

A business economic cycle is the repeating pattern of overall economic activity increasing and decreasing over time. In an economy, rather than a smooth continuous growth, they experience fluctuations measured by a number of indicators such as GDP, employment rates, and industrial production.

The idea of a cycle does inherently say that there is a natural alternation of periods of growth and decline, and within those two distinct phases, business performance and business decision-making will change. By understanding the business economic cycle, businesses can prepare for adverse conditions and exploit opportunities.

Key Features of the Business Economic Cycle:

- An identifiable cycle that consists of alternating phases of economic expansion (growth) and contraction (decline).

- Measurable using key indicators such as GDP, employment and consumer spending.

- Provides an overall context for private sector business profitability that influence business investment and business hiring decisions.

- Can influence businesses ultimate productivity level and ability to grow.

- Is closely related to consumer confidence and specific market trends.

Companies can develop ways to prepare for and respond to the economy’s cyclical movement by understanding the current phase of the business economic cycle.

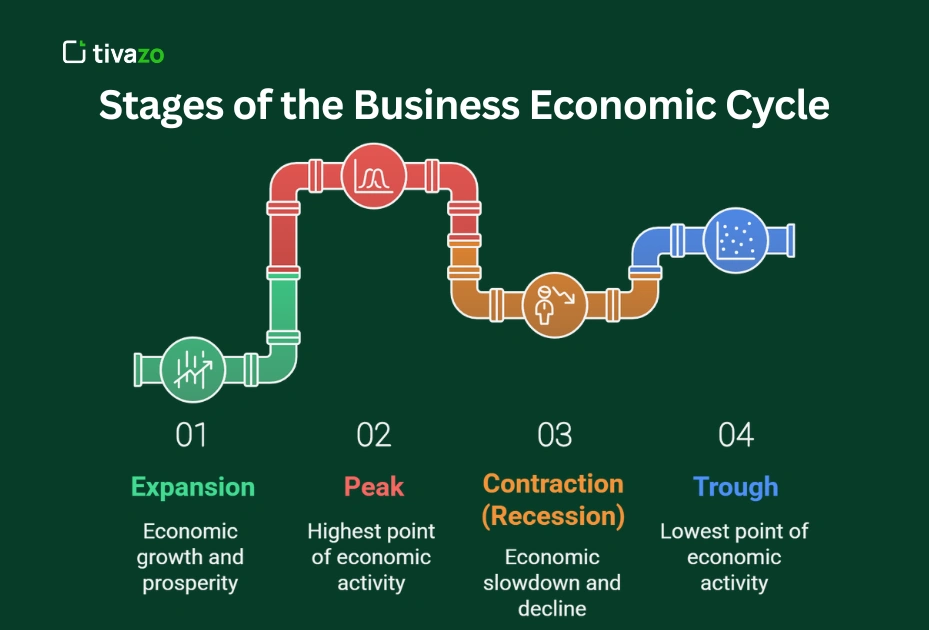

The 4 Main Stages of the Business Economic Cycle

The economy does not move in a straight line. It moves in cycles that follow a pattern over time. These four distinct phases, known as the stages of the business economic cycle, illustrate how economic activity moves over time, and what impacts to a business may occur at each point.

1. Expansion

The expansion phase of the cycle is the growth period when the economy is picking up speed.

- Indicator statistics such as GDP, employment productivity and production are rising steadily

- Businesses are experiencing increased demand, increased sales growth, and increased profits.

- Consumer confidence increases driving greater spending and investing.

Businesses will often hire more employees, introduce new products or services and expand operations to respond to demand during an expansion.

2. Peak

The peak represents the height of the business cycle — the transition period when the economy is about to slow.

- The economy is operating at its maximum productive output.

- Inflation is likely to be strong, driven by increased consumer demand.

- Central banks may increase interest rates to slow the economy down.

During the peak, markets reach a boom stage but already starting to show signs of overheating (tight job markets, inflation, price increases) and getting more stretched for resource limited levels.

3. Contraction (Recession)

This phase signals a downturn in economic activity.

- GDP declines, unemployment rises, and consumer spending drops

- Businesses cut costs, reduce hiring, or downsize

- Investments slow down as uncertainty grows

Contraction can range from a mild slowdown to a deep recession, and companies often shift focus toward efficiency and cost control.

4. Trough

The trough is the lowest point in the cycle and signals the end of the downturn.

- The economy stabilizes and begins to recover

- Business and consumer confidence slowly return

- Opportunity arises for innovation, restructuring, and repositioning for growth

Understanding the stages of the business economic cycle allows businesses to adjust their strategies and make smarter decisions based on where the economy stands — whether it’s time to grow, conserve, or prepare for recovery.

Key Factors Affecting Business Cycles

A variety of factors impact business cycles both from outside of the economy and from inside businesses. Understanding all of these factors is important for businesses to prepare for market fluctuations and their business decisions. These factors many times work in concert and impact consumer demand, production costs and long-term business growth.

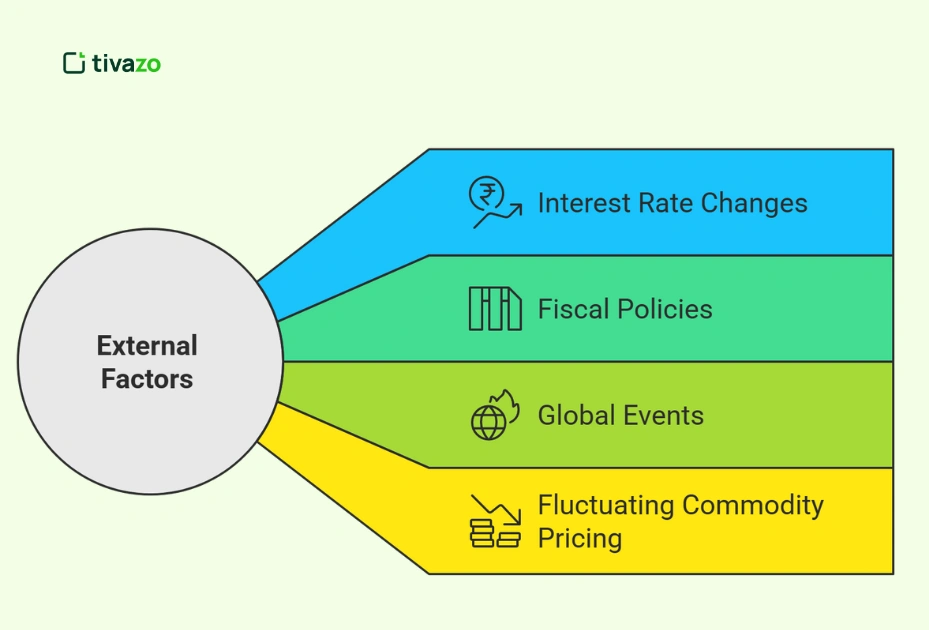

External Factors: The external factors are usually large-scale and typically occur outside of an organizations influence:

- Interest rate changes by central banks– Higher interest rates will slow borrowing from banks and also reduce spending by consumers while lower interest rates will increase spending and service borrowed funds.

- Fiscal policies– changes to taxation and public spending will either inject money into the economy and promote government spending or dissipate demand.

- Global events– pandemics, wars and economic collapses can very quickly change supply chain disruptions and consumer spending.

- Fluctuating commodity pricing– Changes in oil, metals, and food prices can impact production costs and inflation.

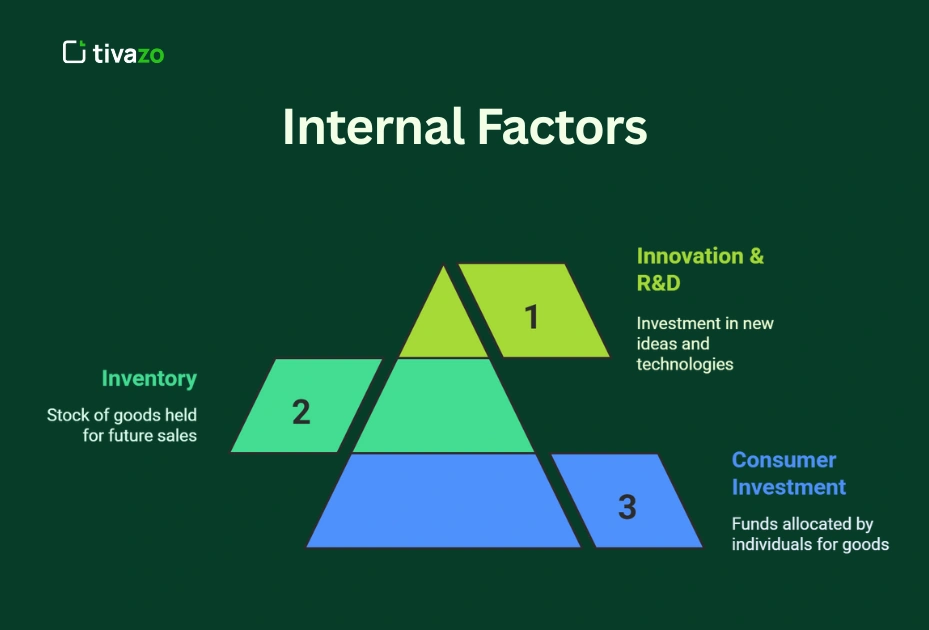

Internal Factors: Internal factors are choices businesses made that can influence the business cycle:

- The level of consumer investment– Businesses modifying their capital investment infrastructure, capital equipment, and expansion plans will drive economic activity.

- Inventory– Excessive or diminished inventory or stock will have negative supply chain productivity and sales.

- Spending on innovation and R&D– New technologies or product lines can drive growth and competitive intensity.

In summary, internal and external factors that affect the business cycles define how economies move from peaks to troughs, and many of the businesses that track these trends are more well-placed to navigate their way successfully through the various peaks and troughs.

Business Cycle and Economic Growth: What’s the Link?

The business economic cycle and economic growth are typically related. Each stage of the cycle which includes peak, contraction, trough, and expansion has a direct influence in defining how quickly or slowly an economy will navigate through time.

- Expansion is the stage that is actively causing economic growth. During this stage, businesses increase production as more workers are recruited and consumer spending increases, and it can be said that GDP increase.

- Even though recessions, or the contraction phase of the business economic cycle will pause growth, the recessionary stages of the economic cycle also helps to correct in the economy either through inflation or through asset bubbles, and also leads into economic floors where we can build from.

How a particular country and its industries deals with the ups and downs of a business economic cycles will dictate sustainable long-term growth. Responsible fiscal and monetary policies and proactive business responses can contribute to stabilizing fluctuations and promoting a more steady path of economic growth.

The Role of Government in Economic Cycles

The government is a big player in the way the business economic cycle operates as they serve to stabilize the economy and spur recovery during a downturn. A mix of monetary policy, fiscal policy and regulatory policy allows the government to ease the suffering of a recession and provide a boost to growth when the economy is expanding.

Key Government Interventions:

- Monetary Policy

Central banks use monetary policy when they change interest rates or the amount of money in circulation to affect the level of economic activity. A great example is during a recession when a central bank lowers interest rates to make borrowing cheaper. If businesses can borrow at a lower rate than previously, they may borrow more money and invest. Or if consumers can borrow money to purchase a new vehicle or build a deck, they are being stimulated to spend which helps the economy and can turn the downward phase of the business economic cycle back upward.

- Fiscal Policy

As well, a government may adopt a more hands-on, or decidedly aggressive level of demand management by either increasing spending or decreasing taxes. Fiscal policy can take the form of increasing or initiating spending on infrastructure projects, such as a $110 billion infrastructure investment plan. Or, a government may choose to stimulate demand by increasing unemployment benefits or even by offering $200 checks to every household, as is often thrown-around in democracies in times of slowdowns.

- Regulatory policy

At certain points during the business cycle, the government may choose to impose certain regulations in some markets, again in the interest of stabilizing, and controlling the shocks. In the case of financial crises, the government can also relieve pressure by loosening regulations in the banking industry. Or more simply, the government may allow banks to secure a liquidity lifeline to re-establish confidence .

Using these tools effectively allows governments to smooth out peaks and valleys in the business economic cycle, reducing recessions’ damaging effects, and smoothing the road to economic recovery. For consumers and businesses alike, understanding the part government plays in the economy is very important for predicting future government policies as it relates to the economy, and developing strategies to utilize those future economic policies as a part of their own strategic objectives.

How Businesses Adapt During Different Economic Cycle Phases

Smart businesses know that each phase of the business economic cycle requires a different strategic reaction. For each economic condition businesses face, they will determine the best course of action for that particular economic circumstance. So, it is important that a business develops a strategy that will maximize their competitive stance – reduce risks – and build profitability and resilience for the long haul.

During An Expansion:

- This is a period of growth, so businesses should focus on preparing to scale up to match anticipated growth.

- Invest in firms or invest in future infrastructure to prepare for rising demand.

- Ramp up hiring and ramp up production to maximize the profits available to the business.

At The Peak:

- As the economy hits its peak, be cautious.

- Pay attention to the fact that costs are increasing and inflation is rising pressures on margins once inflation and acquisitions catch up with it.

- Make sure not to over leverage. Credit is minuscule and interest will become more expensive.

During a Contraction (Recession):

- This is the hardest part of the business economic cycle.

- Cut any associated expenditures that your business can consider non-essential to business operations, and consider how to reduce the scope of your operations.

- Focus on the core income generating resources, and try to build trust, and retention with your loyal customers.

- Enhance your relationships with your existing customers, because trust is a relationship accelerant that produces repeat sales.

At the Trough:

- The economy is beginning to stabilize and prepare to recover.

- Innovate and de-strategize, so you get first-mover advantage.

- Enter new markets or adopt new technologies in order to stay ahead.

As you remain adaptable and change your strategies based on each stage of the business economic cycle, you’ll help to not just survive the downturns you’ll also put yourself in a position for growth during the upswings.

Strategies for Managing Growth and Recession in Business Cycles

In order to remain resilient, businesses need to prepare for the high and low points of the business economic cycle; clear strategies for both growth and recession will not only guard against loss of profits but also give your business a chance at long-term sustained success.

Strategies During Growth Phase:

- When growing and expanding, a business must manage their operations with scale to meet increased demand.

- Develop strong relationships with suppliers to ensure stability as production levels rise.

- Pursue opportunities in different demographic markets to take advantage of increased consumer spending and potential multiple revenue streams.

Strategies During Recession:

- In periods of downturn, the first priority is to protect cash flow.

- Optimize inventory and eliminate excess costs and waste.

- Focus on customer retention for the business to continue deriving revenue from existing clientele even though new demand is not being secured.

Through planning for growth and contraction, a business can work through every ebb and flow of the business economic cycle with certainty and continuity.

Understanding the Impact of Inflation and Interest Rates

Inflation and interest rates are two key influencers that can either drive or throttle the business economic cycle, either facilitating expansion, or delaying growth based on how they both are managed.

Inflation Impacts:

- Inflation causes a reduction in the purchasing power of the consumer, and the cost of goods and services becomes greater.

- Inflation increases production costs, which will in turn reduce profit margins for businesses.

- Ultimately, inflation could decrease consumer demand which would then suppress economic activity over time.

Interest Rate Impacts:

- Interest rates increase the cost of borrowing, which deter businesses from investing, and slowing growth.

- Interest rates decrease the cost of borrowing, decreasing the cost of spending, which encourages expansion and stimulates the economy.

By making sense of how inflation and interest rates impact the business economic cycle, businesses can be smarter with pricing, investment, and cash flow decisions at the various stages of the cycle.

Smart Moves to Thrive in Any Business Economic Cycle

Companies must develop flexibility and resilience into their operations to weather any type of business economic cycle. The five strategies below can help businesses be flexible and resilient in changing economic circumstances for long-term sustainability:

Diversify Your Revenue Streams – Relying on one product or market is nearly always a recipe for disaster. By diversifying products or services into different sectors or industries, businesses can reduce their susceptibility to an economic down cycle.

Have Healthy Reserves of Cash – During a recession, cash flow can be critical. Having enough cash reserves can essentially act as a financial cushion and allow businesses to make decisions without panic in anticipation of an unexpected slow-down.

Invest in Digital Transformation – Technology allows businesses to operate more efficiently and cost effectively, making them more competitive throughout varying economic circumstances.

Invest in Retaining Your People and Training – A well-trained, happy, and loyal workforce is critical to driving innovation and helping steady your business throughout the business economic cycle.

Use Data as Part of Decision Making – Having valuable, real-time data can help you identify trends as they surface and allow leaders to change their strategies based on where they are in the business economic cycle.

Collectively, these proactive behaviors will help position companies to not just survive, but flourish—regardless of more favorable or less favorable economic circumstances.

Conclusion: Be Proactive, Not Reactive

Every business is trapped within the scope of the business economic cycle, it is not going away – in fact, it is one of the only consistent perspectives within the economy. Smart companies do not think of it as a threat; they think of it as a map with detours, roadblocks, and possible shortcuts along the way.

Every business, regardless of its stage of development, should come to understand the stages of the business economic cycle, be aware of the internal and external variables that impact the cycle, and strategically respond with internal business strategies. It is possible to minimize risks while in a contraction phase, as well as capitalize on growth in an expansion phase – whether that be from spending money in a contraction phase or growing quickly and scaling efficiently in an expansion phase; the preparation makes all the difference.

Some of the strongest businesses adapt their plans and navigate the economy – they do not let the economy dictate their course. They are prepared and adaptable to the changing landscape. To put it simply, being proactive instead of reactive, allows businesses to remain viable, competitive, and ready for the future – regardless of what phase of the economic cycle you are in.